BusinessMarketing

ATA Business School: Profit Margins 101 (Part 1)

There’s no margin for error when it involves your business and profit margins.

Photo Credit: ATA

The ATA’s 2019 member survey asked: “What’s the biggest educational or training need for industry retailers?” Many members replied: understanding profit margins.

We spoke with Randy Phillips, owner of Archery Headquarters in Chandler, Arizona, for insights from his 30 years in business. Phillips said he lost profits his first three years because he didn’t fully understand profit margins. Since then he’s run a successful and efficient pro shop.

In this article, Part 1 of a two-part series, Phillips defines profit margins, how they’re calculated, and why they can frustrate retailers. In Part 2, you’ll learn how to build more profits into your business.

To start, let’s define “profit” as a financial gain. It’s the difference between an amount you earn, and what you spent buying, operating, marketing and producing something. In short, it’s money you keep or invest after paying your bills.

In turn, “profit margin” is the ratio of a company’s profit to revenue. Profit is measured in dollars, and profit margin is measured as a percentage. Your margin must be more than what you paid for the product and overhead expenses to make a profit.

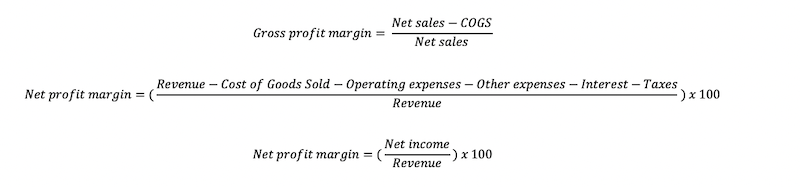

Phillips said retailers should also know the difference between gross profit margin and net profit margin, which are calculated differently. According to Investopedia, the gross profit margin formula is net sales (how much you sold the product for after sales returns and discounts) minus the cost of goods sold, divided by net sales. Then, multiplied by 100. So, if you buy a product for $80 and sell it for $140, you calculate 140 minus 80 divided by 140, which gives you 0.4. Multiply that by 100 to get your gross profit margin, or 40%.

The formula for net profit margin is net income divided by net sales, multiplied by 100. Calculate net income by subtracting the item’s selling price by your product cost, operating expenses, interest, taxes and other expenses. Using the same product costs as above, your calculation is $140 (selling cost), minus $80 (product cost), minus $20 (an estimate for taxes, marketing and other overhead expenses). That gives you $40 (net income). Divide that by $140 (net sales), and you’ll get 0.28. Multiply that by 100 to get your net profit margin, which is 28%.

Calculating overhead expenses for one item is hard. You can, however, calculate your net profit margin for specific time periods, such as a month or quarter. Here’s the calculation for a retailer who does $10,000 in monthly sales, paid $6,000 for those products, and has a monthly overhead of $2,000. Subtract overhead ($2,000) and cost of goods sold ($6,000) from your revenue or net sales ($10,000), and then divide by net sales ($10,000) to get 0.2, which you multiply by 100 to get your monthly net profit margin of 20%.

Phillips said many retailers think they’re making the gross profit margin, which would be 40% in the example above, but they really only make the net profit margin, which was 28%, or 20% in the monthly example. “People forget to factor in other business expenses like their overhead costs, and don’t realize their error until it’s too late,” Phillips said.

That mistake is one of five common profit-margin errors below.

The answer varies by business, but it’s likely one of the five reasons:

Many archery shop owners started their business because they love archery. Phillips said they understand the broad scheme of business, but not the many ways money flows in or out of their business. It’s more important to know how to calculate finances. “Some retailers look at their numbers but don’t really know what they’re looking at,” Phillips said. “They don’t realize they’re losing money until their accountant tells them.”

Take the time to calculate margins and see what you can price an item at to make money and what you can put on sale. Photo Credit: Archery Headquarters

Some shop owners spend lots of time helping customers, stocking shelves, repairing equipment, maintaining their shop, and teaching lessons or classes. These time-consuming tasks make it difficult to crunch numbers, so retailers forgo or delay calculating profit margins. When Phillips sees that happening with clients he consults, he says, “Your business has been running you, but now you’re going to run your business.” He encourages them to be proactive about buying and selling.

Phillips said most shops pay 40% of their net sales in overhead. He said efficient shops pay about 30%. When retailers calculate their gross profit margin and see a 40% profit margin, they think all is well. But because the equation for gross-profit margin doesn’t include overhead costs like the equation for net-profit margin, retailers often lose money or break even after paying their bills. “If your overhead costs are 40% and your profit margins are 40%, you’re netting zero,” Phillips said. “[Retailers] think, ‘I didn’t sell enough.’ The truth is, they didn’t charge enough because they overlooked their overhead expenses.”

Base your prices on margin, not markup. Photo Credit: Archer Headquarters

The “markup percentage” is the percentage difference between a product’s cost and its selling price. Meanwhile, “gross-margin percentage” is the percentage difference between a product’s selling price and its profit. Margin is calculated off the selling price, not the product cost. Retailers should use margin, not markup, to learn how much they’ll profit.

For example, a 30% markup on a $100 product creates a $130 selling price. However, a 30% margin on a $100 product sets a $142.86 selling price. A business operating on “margins” makes $12.86 more than one operating on “markups,” which means a 30% “margin” is actually a 43% “markup.”

Phillips said every percent matters, especially in the archery industry, which has lower margins than most industries.

“The archery industry is full of hobbyists and enthusiasts who like to work for nothing, so our margins are driven down to the point of crucial,” Phillips said. “A percent is everything because all those little ‘percents’ add up.”

Phillips said a profitable shop makes a 15% profit, but bicycle shops likely make 25% to 30% profit. Archery retailers must “get as much margin as they can, any way they can,” Phillips said.

Once you identify your mistake(s), you can learn from them and improve your business. In Part 2, which we’ll post May 20, we’ll explain how to boost your profit margins and craft a plan that ensures your business is profitable.

WE ARE HERE TO HELP THE INDUSTRY, TO HELP INDIVIDUAL BUSINESSES GET THE MOST OUT OF THE INDUSTRY, AND TO HELP YOU.