Understanding Your Legal, Ethical Options

To combat these issues, retailers have two options:

- Buy commercially made bowstrings from manufacturers who factor in the FET.

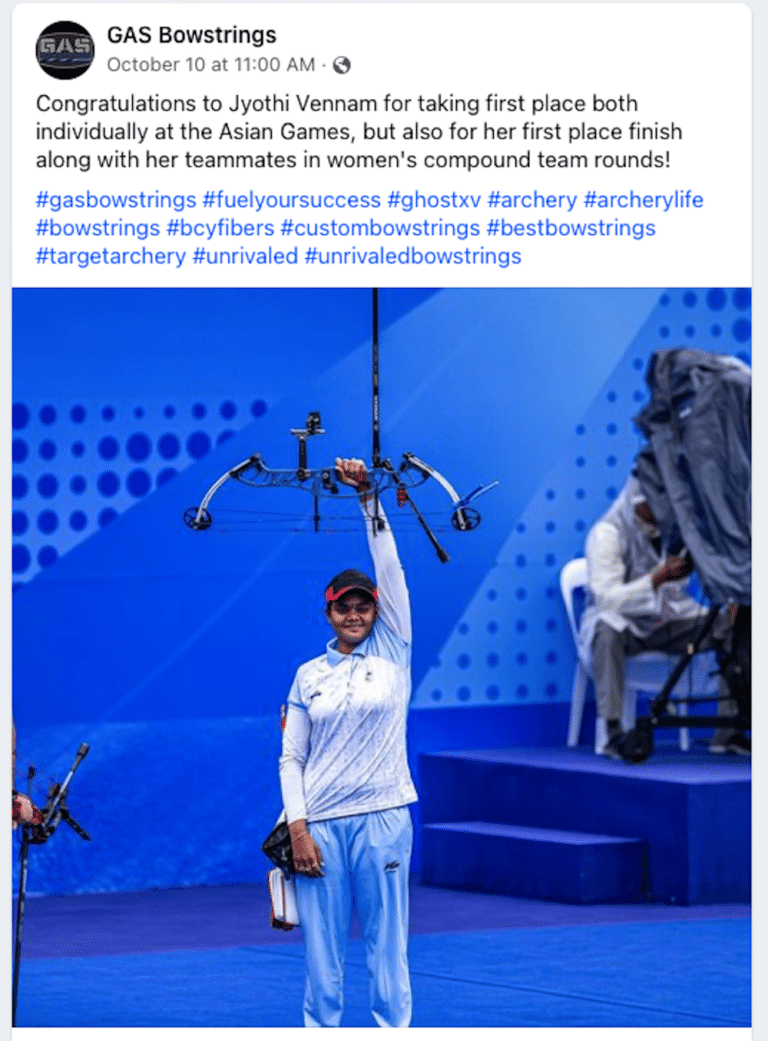

Established companies specialize in string building and have years of experience. They have relationships with bow manufacturers and know the proper bowstring specs for individual bows and cam systems. They pay the FET, consistently make reliable products backed by warranties, and often give back to the industry by sponsoring elite archers and archery competitions and organizations.

“We take care of all the pieces,” Griggs said. “Specs for strings, engineering, product liability, FET — we produce a turnkey service. As a dealer, all you have to do is order the string and install it. If (the string) wasn’t right and you’re working with a good vendor, they’ll take care of you. Reputable companies are known for their quality and service.”

- Continue making bowstrings, but pay the FET and carry proper insurance.

If you have the supplies, like to make strings and wish to continue selling to customers, you must abide by the law and pay the FET.

“It’s not like you have to stop doing what you’re doing,” Forster said. “If making strings is your bread and butter, you just have to be aware of all these things and account for all the expenses.”

Griggs agreed: “I’m not trying to discourage anyone from building strings, but if you’re going to do it, do it in a way that’s fair for everyone and supports that industry.”

ATA Resources

The ATA can help its members make the best decision for their business and comply accordingly. Whether you need assistance finding a reputable aftermarket string manufacturer or want guidance on which forms to complete and when to pay the required federal excise taxes, we’ve got your back.

“The best solution is to bring everyone into compliance,” Forster said. “We don’t want to see anyone get blindsided and trust that none of our members are purposefully trying to avoid paying the tax. Don’t hesitate to reach out if you have questions.”

ATA members can find important FET information, including a free comprehensive guide to federal excise taxes, in the ATA’s Resource Library. You must go through the checkout process in your ATA member dashboard account to obtain the document (and many others) but don’t worry, they’re free!

For FET-related questions and concerns, please contact Forster at danforster@archerytrade.org.