Business

8 Ways to Cut Costs Without Hurting Your Business

Use these tactics to save money or spend smarter so you can do more with the money you have.

Photo Credit: ATA

Inflation. Need we say more? Probably not, but we will. Rising costs have put added pressure on many businesses. You likely already bought parts to make products and placed orders for the year ahead; it’s unlikely you can return or cancel items. And we don’t think you should. So, what other options do you have to cut costs and stay afloat besides laying off employees and potentially ending up shorthanded? Try these eight tactics.

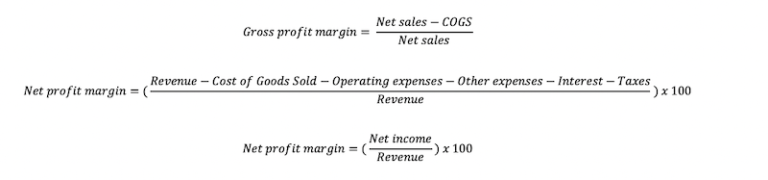

Calculate your profit margins. Photo Credit: ATA

First things first, nothing you do is more important than evaluating your profit margin. You can’t price items according to last year’s sales data because the market and economy have changed. You must redefine what constitutes an acceptable profit margin. For example, if your overhead accounted for 20% of overall sales in 2020, then making a 30% profit margin could be good. If overhead is 35% of sales in 2022, then a 30% profit margin means you’re losing money. Look at the costs of goods and your overhead expenses to adjust your profit margin accordingly. Customers don’t want to see product prices increase, but it’s necessary to stay profitable, given the conditions. If you need help determining a positive profit margin, read these ATA articles.

Install a temporary no-overtime policy for your employees if you can manage on the cut-and-dried 40 hours a week per employee. If you can’t manage the workload and keep up with your current turnaround times, consider adjusting your service work timelines. If you do that, be sure to reset customer expectations. They’ll probably understand if you explain the extended turnaround time as a mandatory change to stay in business. When it comes down to it, waiting a few extra days to receive their equipment is better than not having a shop to take their gear to.

Another alternative is to allow employees to take off without pay if you can manage. This option will be more likely during the slow season, but it might be applicable if things are running smoothly. The hunters on your staff might jump at the opportunity if it’s offered. This strategy, and the one above, can save your company money in hourly wages while preserving jobs and potentially increasing employee satisfaction.

There are a handful of insurance companies on our MyATA Service Providers page. Photo Credit: ATA

When you signed up for your insurance, phone or internet plan, you probably shopped around for the lowest price, but how long ago was that? Take some time to compare prices and rates from other companies to find the cheapest option. Many brands offer deals for switching or have special offers and contracts for new customers. Saving $10 or $20 doesn’t seem like much, but the savings add up over time. You might be able to get a new phone or extra insurance coverage with a new carrier, which would have been out of the question with your old company.

If you use several marketing techniques like email, radio, social media ads, coupons and influencers, now’s a good time to analyze them individually to determine which are the most effective. It’s probably not wise to stop all marketing efforts, but halting the least effective ones can save you money. For more information, read ATA’s article “Evaluate Your Marketing Efforts: What’s Working, What’s Not, and How To Fix It.”

Rent, utilities, office supplies, etc. Yes, all these things are essential to operate, but since they’re recurring monthly charges, they’re often overlooked expenses. You might be able to reduce costs by negotiating a lower temporary rent, trimming back on your office supply order, and turning off the bathroom, office or range lights when they aren’t in use. Also, make a list of the software programs, business subscriptions and other applications you pay for and don’t use anymore, which can be canceled.

During an economic strain, you must trim as much wasteful spending as possible.

As a business owner, you might treat your staff to company-provided meals, free gym memberships or seasonal office parties. If that’s the case, pausing these nonessential expenses will help ensure you have a strong cash flow. You can also stop offering customers free coffee or stop ordering and giving away branded swag items. These things don’t directly impact your business and can be stopped and started anytime to help compensate for marketplace fluctuations.

You might be in charge of your business, but your employees are likely very familiar with it. Ask them for their input to see what ideas they have or if they have a preference regarding the ideas above. Working through financial hardships together fosters a collaborative environment built on trust.

If something doesn’t increase profitability or it costs too much, it’s time to evaluate its worth to make make-or-break decisions. This cost-cutting exercise isn’t about cutting corners that might hurt or jeopardize your company; it’s about finding ways to spend smarter so you can do more with the money you have.

WE ARE HERE TO HELP THE INDUSTRY, TO HELP INDIVIDUAL BUSINESSES GET THE MOST OUT OF THE INDUSTRY, AND TO HELP YOU.