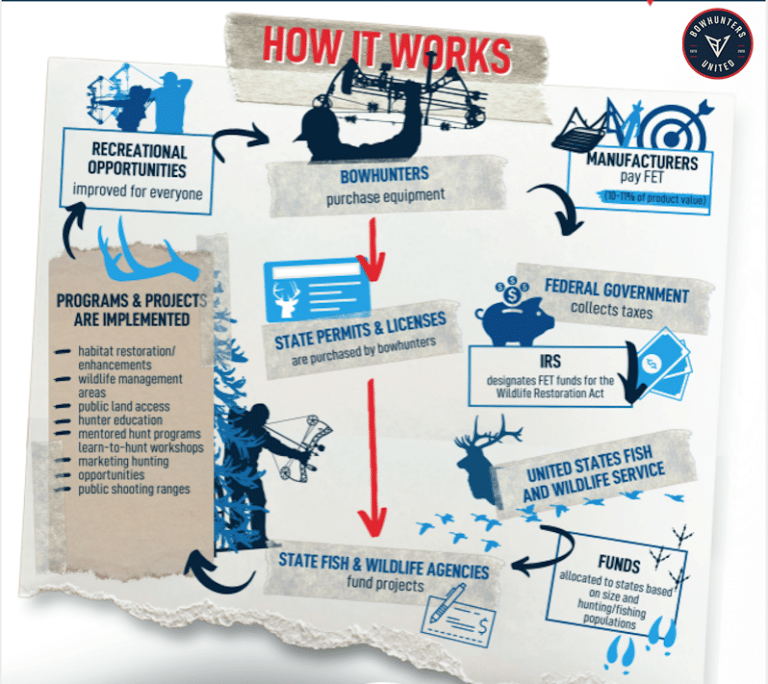

The Flow of Funds

All companies responsible for paying FET must file a quarterly excise tax return using IRS Form 720. The IRS collects all revenues generated by the FET and sends them to the U.S. Fish and Wildlife Service, which apportions the allotments only to state wildlife agencies and territories based on their geographic size and their paid hunting and fishing license holders. The fishing industry pays a similar FET through the Dingell-Johnson Act.

For states to receive these federal grant funds, they must include a 25% match of nonfederal funding in their proposals. Most states use money generated by license sales to pay the match. In other cases, state agencies partner with colleges, conservation organizations and other groups to raise additional conservation dollars to match the federal funding. These collaborations are mutually beneficial because once the state receives the federal fund approval, both parties work on the project. Volunteer hours (for hunter education programs) can also be converted and used as a match. Only projects meeting the intended purposes of the Pittman-Robertson Act are approved by the U.S. Fish and Wildlife Service and eligible for funding.

The state agency receives the funds after the work on an approved grant is completed. If a state doesn’t complete a project or allocate the funds after a certain period, the funding reverts to the USFWS for the Migratory Bird Conservation Commission, which uses it to buy land for the National Wildlife Refuge program.

Supporting the Mission

Paying an 11% tax might seem like a lot, but it’s a small price to pay to ensure our natural resources are properly managed so people have ample hunting opportunities and businesses can grow and flourish with vibrant consumer participation.

Keith Arnold, national sales manager for the TenPoint and Wicked Ridge Crossbow brands, knows his company is legally obligated to pay federal excise taxes. He also understands the magnitude of his company’s contributions and the investment value of paying taxes, so the brands proudly pay their share.

“Our hunting lifestyle has greater challenges today than ever before,” Arnold said. “With each day that passes, more land is developed and our youth’s attention finds new distractions. The FET program ensures that significant resources are focused on doing what most of us don’t have the time or bandwidth to do — work on protecting and furthering our passion so that future generations can do what we love.”

How States Leverage FET Funds

States must use FET contributions for habitat restoration, hunter education, wildlife research, public-access programs and other high-priority national conservation projects.

In 2023, the Pennsylvania Game Commission received a record $41 million in FET funds and used the money for several projects. Here are a few statistics from programs and projects that received FET dollars.

- National Archery in the Schools Program: With over 300 schools participating, more than 100,000 students in grades 4 to 12 engaged in the NASP in 2023. Of those students, 20% purchased a hunting license and 268 participated in the 2023 NASP International Bowhunter Organization’s 3D state tournament. Archery-dedicated youth programs create recreational archers and future hunters.

- Hunter Education: In 2023, 16,904 students graduated from in-person hunter and trapper education classes, 73% of whom were 20 or younger. Meanwhile, 6,592 students graduated from the online HTE course. These programs help get more people into hunting and bowhunting, buying licenses and equipment to participate.

- Range Development and Maintenance: The agency is currently creating or enhancing 16 shooting ranges for firearms and/or archery. At the completion of the 2024 fiscal year, the agency will have 52 different public ranges. Public ranges ensure people have opportunities to shoot recreationally and practice for hunting season.

The FET helps boost the archery and bowhunting industry by ensuring people have places to hunt and animals to pursue. And of course, this means more money in the pockets of archery store owners and manufacturers.

“Without P-R dollars, I think [the impact on] state wildlife agencies’ ability to deliver conservation would be catastrophic,” Burhans said. “Some states struggle to come up with the match required to obtain the funds. The program is essential to what we do to maintain conservation, and recruit and retain hunters.”